You’re a small or mid-sized business owner. You’re sitting on some extra cash. You’re looking for ways to protect it from inflation.

Is now a good time to buy Bitcoin?

The days of sitting on idle cash without consequences are over. Excess cash in your bank account is no longer safe. It’s slowly melting away, or as Michael Saylor puts it:

It’s a melting ice cube.

I’m not referring to cash necessary for working capital or earmarked for specific needs. I’m talking about your retained earnings, sitting idle and losing value.

But Why Is This Happening?

Many Bitcoiners and gold advocates trace the root cause to August 15, 1971. That’s when President Richard Nixon ended the convertibility of the U.S. dollar into gold for foreign nations—a move that effectively ended the Bretton Woods system.

With that, the global financial system entered the era of fiat currency: money not backed by a physical commodity.

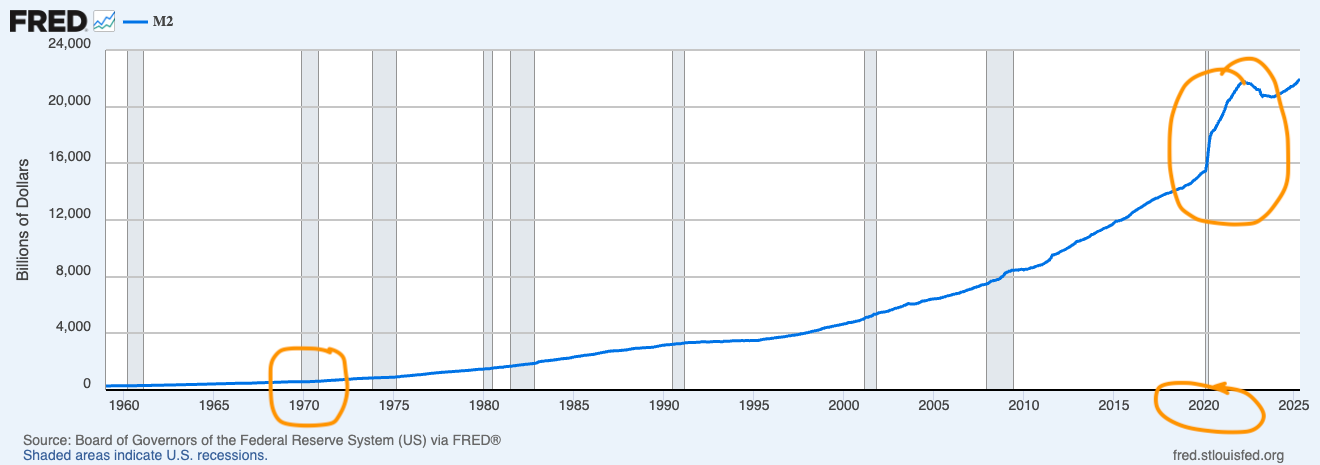

Modern Monetary Theorists argue that expanding the money supply is necessary to fuel economic growth. Meanwhile, proponents of the Eurodollar theory argue that offshore dollar creation renders Fed control somewhat meaningless.

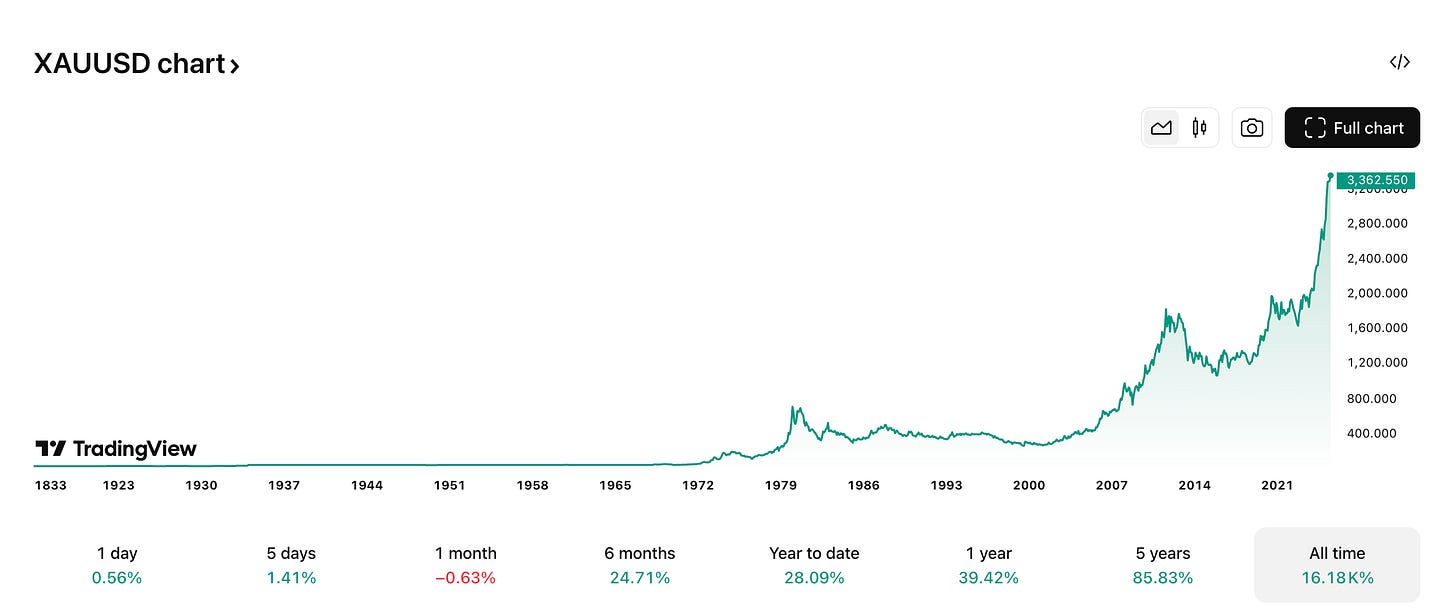

Regardless of the lens through which you view it, the result is the same: a dramatic and ongoing expansion of the money currency supply. Dollars, euros, yen, francs—even Canadian “Moose Shekels”—all chasing scarce assets.

Previously those assets were primarily real estate, stocks, and gold. Now, Bitcoin is gaining in market share.

But What About Tariffs?

Yes, tariffs do raise prices. But they do so in specific sectors and reflect geopolitical and trade dynamics.

During the pandemic, prices rose across all categories, despite minimal tariff changes. That inflation was a direct result of monetary expansion, not trade policy. Understanding this helps separate monetary inflation (caused by printing money) from price increases caused by the laws of supply and demand or policy.

Notice any parallels between the increase in money supply and the increase in the price of gold?

Let’s take a look at historical Bitcoin prices.

So, What Does This Mean for You?

Your dollars are being diluted.

Think about what $100,000 could buy you in 2015 versus today. In real terms, you’ve lost purchasing power, even if the balance in your account hasn’t changed.

This isn’t financial advice. But it is something to think deeply about.

But Bitcoin Isn’t Backed by a Physical Commodity

Bitcoin doesn’t need to be backed by a physical commodity because it is digitally scarce. Sounds like an oxymoron, I know.

With a fixed supply of 21 million coins, it introduces a monetary policy YOU can audit, verify, and participate in.

I can’t stress the importance of using Bitcoin for yourself before passing judgement enough.

As Alex points out in this week’s episode of AAB21Q, take time to explore Bitcoin before going all in:

Buy (or earn) a small amount.

Set up a node.

Audit the protocol.

Send, receive, experiment.

Stay aware of macroeconomic trends and form your own view.

A Fun Way to Start

As always, I highly encourage you to watch the latest episode of AAB21Q. This week’s bounty is 21,000 sats. Find the 12-word seed phrase hidden in the episode, recover the wallet, and the sats are yours… provided that you move them before someone else finds the seed phrase!

Final Thoughts

As a business owner, your job isn’t just to run operations—it’s to protect your capital. In my personal experience, Bitcoin has helped me do just that.